Five Minutes for Finance - Fiscal Sponsorships

Using and Acting as a Fiscal Sponsor in the Nonprofit Sector

Fiscal sponsorship is a powerful tool in the nonprofit sector that allows charitable projects to operate under the umbrella of an established nonprofit’s tax-exempt status. It can be a mutually beneficial arrangement—helping emerging initiatives get off the ground quickly, while also enabling established nonprofits to extend their mission impact in strategic ways.

Understanding fiscal sponsorship from both sides—using one and acting as one—is key to ensuring the relationship is effective, compliant, and mission-aligned.

What Is Fiscal Sponsorship?

At its core, fiscal sponsorship is a formal arrangement in which a 501(c)(3) or 501(c)(4) nonprofit agrees to accept and manage funds on behalf of a project or group that does not have its own tax-exempt status.

The most common models are:

Comprehensive (Model A): The sponsor has full legal and fiduciary responsibility for the project, treating it as an internal program.

Pre-Approved Grant Relationship (Model C): The sponsor funds an independent project through grants, but the project retains more operational independence.

Using a Fiscal Sponsor (Sponsored Project Perspective)

Example:

A group of community volunteers wants to run a summer food program for children in low-income neighborhoods. They partner with an established food bank that becomes their fiscal sponsor, enabling them to accept tax-deductible donations and use the food bank’s insurance coverage while focusing on organizing meal distribution.

Benefits

Immediate access to 501(c)(3) status for fundraising and grant eligibility.

Administrative support such as bookkeeping, payroll, and compliance oversight.

Credibility with funders through association with an established organization.

Considerations

Fees and costs: Often 5–15% of funds raised.

Control and compliance: Must follow sponsor’s rules and policies.

Exit strategy: Important if planning to eventually form an independent nonprofit.

Best Practices

Select a sponsor with a closely aligned mission.

Communicate frequently and transparently.

Track program results for reporting to the sponsor and funders.

Acting as a Fiscal Sponsor (Sponsoring Organization Perspective)

Example:

A regional arts council agrees to fiscally sponsor a start-up youth theater troupe, providing financial management and grant administration while ensuring the troupe’s activities support arts education—a shared mission area.

Benefits

Mission expansion without creating new in-house programs.

Partnership building with grassroots leaders and innovators.

Revenue stream from administrative fees that help cover overhead.

Responsibilities

Legal accountability for all sponsored funds.

Oversight and compliance to ensure proper use of charitable assets.

Risk management to protect organizational reputation and finances.

Best Practices

Use written agreements covering responsibilities, reporting, termination, and intellectual property.

Vet potential projects for mission fit, leadership capacity, and fiscal viability.

Provide training and ongoing support for sponsored projects.

Opportunities for Both Parties

Rapid Launch for New Initiatives – Projects can start work immediately without waiting for IRS approval.

Capacity Building – Projects gain access to experienced administrative teams, while sponsors strengthen their network and sector presence.

Innovation Testing – Both sides can pilot new ideas without the cost and risk of starting a full independent nonprofit.

Expanded Fundraising Potential – More grants become available when projects have 501(c)(3) backing.

Community Impact Amplification – Mission-aligned collaborations can multiply reach and effectiveness.

Risks and Challenges

For Sponsored Projects:

Limited autonomy due to sponsor’s policies and decision-making authority.

Risk of sponsor mismanaging funds or being slow with disbursements.

Possible conflict if missions or strategies diverge over time.

For Sponsors:

Legal and financial liability if a project engages in improper activities.

Administrative burden that can strain existing staff and systems.

Potential reputational damage if a sponsored project becomes controversial.

For Both:

Miscommunication leading to misunderstandings about roles and expectations.

Unclear agreements that create disputes over intellectual property or fundraising lists.

Mission drift if partnerships are formed without strong alignment.

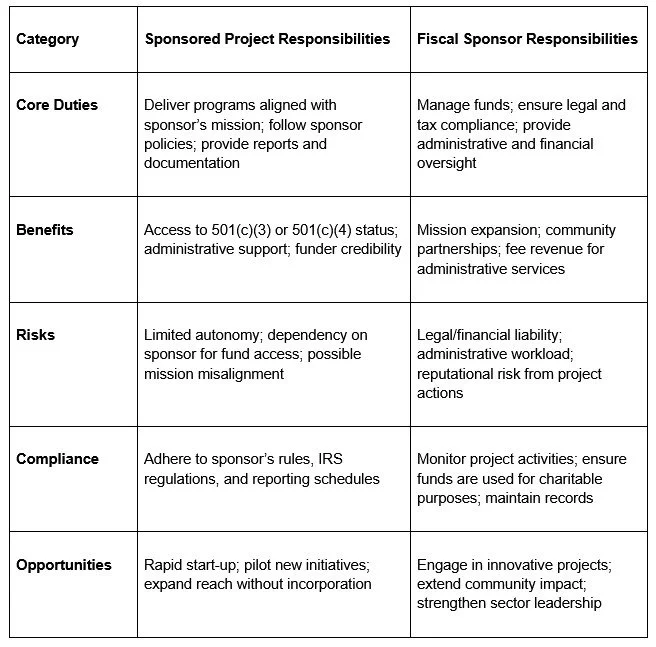

Side-by-Side Comparison: Sponsored Projects vs. Fiscal Sponsors

About this Series

Subsequent articles in this series will cover other topics related to nonprofit financial management. Here is a list of, with links to, previous articles:

About the Author

For over 30 years, Robert Pascual has been a leader in nonprofit financial management as a CFO, consultant, conference speaker and educator. He holds an MBA from the Haas School of Business at the University of California and is the founder and principal of Robert Pascual, MBA LLC. He has worked with small, mid-size, and large nonprofit organizations spanning the fields of education, workforce development, housing, health, philanthropy, social services, media, fiscal sponsorship, nature, and the environment. Each of these organizations has faced both unique and common challenges, some of which are probably similar to ones that you wrestle with.